The winner, the loser in the coffee price crisis

09:05, 19/04/2019

7430 lượt xem

7430 lượt xem

Coffee is one of the worst performers in the past few years as the world has a surplus of coffee and there are few signs that this commodity will rise again in the future.

The winner, the loser in the coffee price crisis

When arabica coffee prices fell near the lowest level in 13 years and futures prices of Robusta coffee were also not satisfactory, concerns about the stability of the industry were threatened.

Bloomberg synthesized beneficiaries as well as suffered losses due to reduced coffee:

Coffee processing factory

The decline of the coffee industry means that coffee processing plants, such as owners of Maxwell House and Folgers brands, Kraft Heinz and JM Smucker, are paying a lower price for the coffee they purchase. .

Such low prices can be profitable for companies like Smucker with the company's vote reaching its highest level in a year.

The number of future arabica contracts has dropped to its lowest level since 2005.

"Big coffee processing factories will get big profits," said Jeffrey Young of Allegra Strategies, a consultancy.

However, the benefits that coffee processing plants receive may still be limited. For example, producer Jacobs Douwe Egberts said they save for their customers.

Consumers

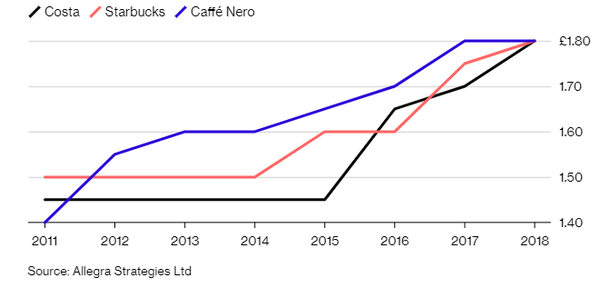

Coffee drinkers in drink shops are actually paying more for a cup of coffee than in 2011, such as the price of an espresso cup in the Starbucks chain in the UK has increased by about 20%.

However, this does not mean that customers are being deceived, according to Young.

"Coffee represents only a fraction of the cost of running a café," Young said. Rent for premises and equipment has increased, while other materials and currency fluctuations have also affected the price of a cup of coffee.

The price of an espresso cup in the UK has increased since 2011.

However, some food stores are taking advantage of the weakening of the coffee industry to buy this kind of product at a low price, according to Mr. Marcus Swift, commercial director of UCC Europe coffee roaster, where supply Coffee for McDonald's and Greggs.

Monetary managers

Speculators have bet on the decline of arabica coffee prices since August 2017 and have taken profits when the price of this coffee has dropped by about 30% since then.

Monetary managers are betting that prices will continue to fall. The net selling position was at its highest level in 6 months, according to the latest US government data.

Speculators won thanks to falling arabica prices.

Futures for arabica coffee fell 7.5% this year to 94.2 US cents / pound in New York.

Coffee farmers

Like all industries, low prices are bad news for manufacturers. In some coffee growing countries, the price of arabica coffee on the market has been lower than the cost of production and it is difficult for farmers to immediately switch to other crops. This situation occurs because coffee trees will live for several years once they are planted.

Coffee growers in Vietnam, the main producer of robusta coffee, have stocked up coffee while waiting for prices to improve, according to the Intimex Group.

In Honduras, low prices are preventing farmers from harvesting crops because they cannot pay coffee collectors or pay input costs like fertilizer, according to the National Coffee Exporters Association of the country.

Trần Nam Thi

According Economics & Consumer